Mukuru reduces

absenteeism & cuts

loan requests using

Jem

CLIENT

Mukuru

INDUSTRY

Financial Services

EMPLOYEES

+540

PRODUCTS

Earned Wage Access

PAYROLL SYSTEM

PaySpace

96%

Reducing in loan processing time

100%

Reduction in loan

requests

Project Overview: Mukuru

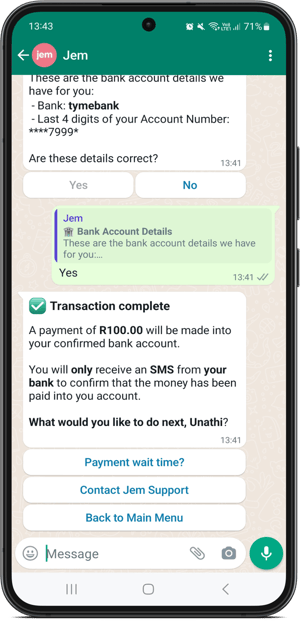

Mukuru is a financial services company that helps millions of people across Africa send and receive money. Their HR department wanted to find a way to provide their + 540 staff with safe and affordable salary advances instead of administering company loans, or letting them turn to predatory lenders.

Challenges

- Processing employee loans was an “admin nightmare.” Payroll would have to administer the entire process from approving applications and arranging payment through their treasury team, to adding the loans to payroll and coordinating the loan repayments with each employee, which took ±7 hours/month.

Results

96%

Reduction in loan processing time

100%

Reduction in loan

requests

- Since implementing Earned Wage Access, Mukuru has received 0 loan requests.

- Mukuru’s HR time spent on the employee loan process decreased by 96% per month (from 7 hours to 15 minutes).

- 30% of Mukuru employees use their salary advance for transport to get to and from work. As a result, Mukuru has noticed a decrease in employee absenteeism.

Earned Wage Access

"Before we joined Jem, we used to process 80 staff loans a month and it was an admin nightmare. Now, we just send our employees to Jem when they are in financial stress. It has been such a pleasure and our employees absolutely love it."

LEANA PRETORIOUS SENIOR PAYROLL PARTNER, MUKURU